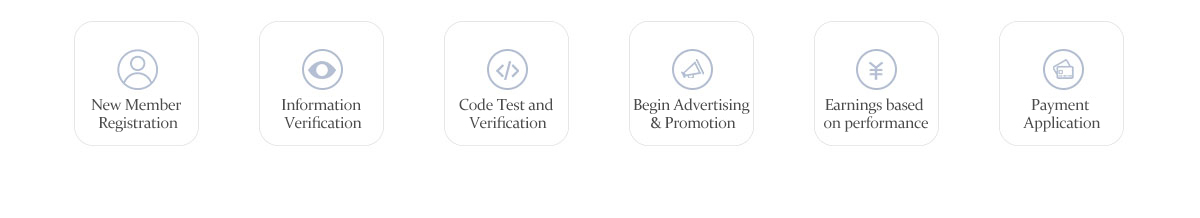

Partnership Process

Network Advantages

Frequently Asked Questions

What is a LinkHaitao Network Member?

On LinkHaitao.com, Members filter and select advertisers (online retailers & merchants) based on their site’s target market and audience. Publishers than can create content and promote the advertiser based on the agreed terms. Every LinkHaitao member then receives corresponding remuneration based on their performance. Final remuneration settlements will be calculated based on LinkHaitao browsing records and based on the LinkHaitao terms and conditions.

How can I join the LinkHaitao Network?

Once you register successfully and your website is confirmed, you are in!

Do members need to pay the membership fee?

No. Once you join the LinkHaitao Network, you will benefit from unlimited resources provided by LinkHaitao at no cost.

When to begin advertising after registration?

After online registration, LinkHaitao will review and verify your submitted information. Verification will include verification and legal ownership of your claimed website. If any information is invalid or cannot be verified, the application will be declined and those applicatns cannot benefit from resources provided by LinkHaitao.com.

How can I check my advertising performance?

Linkhaitao. com will constantly monitor online advertising performance and record any and all relevant information. We will also provide reports on a regular basis for our members and advertisers.

What does Return Days (RD) mean?

Return Day(s) or RD are the number of days that your advertisement will be valid for compensation from the advertiser. If a user purchases within the return day limit after clicking a link on your site you will be compensated for that sale. If a sale happens after the specified return days, you will not be credited for the sale. For example, an internet user clicks to an advertiser site from advertisements promoted on your site. The user browses for a given product on the advertiser site, as long as the user buys the product after clicking from your site and before the return days expire, you will earn commission. The LinkHaitao system will track Return Days and ensure that all credit is properly given, site owners do not have to monitor Return Days.

When will the advertisers check results and promotional performance?

Performance check period( The example is based on remuneration of October)

1、September 1st thru September 30th - Network members (Site Owners) advertise

2、November 1st thru November 30th - Advertisers verify and adjust performance data based on actual sales for first round with LinkHaitao.They then settle accounts payable.

3、December 1st thru December20th - Linkhaitao checks the performance data with the data provided by advertisers for second round. Then Linkhaitao will settle down the accounts payable to members.

*Settlement dates may be delayed depending on any holidays.

When will the Network members receive remuneration?

(1)Remuneration Application Date: 10th -14th each month

(2) Finance Department Processing Time: 1 Business Day

(3) Remuneration Remittance Date: prior to 20th every month

What is taxation rate of Remuneration?

-The taxation rate will follow the national personal income tax rate of remuneration in People’s Republic of China.

-We will calculate the monthly taxes based on the total amount of remuneration applied by taxpayer.

Remuneration Remittance Methods:

1.If members are registered as private corporations, members should issue invoices and provide corresponding bank account information. We will remit payments to corresponding accounts.

2.If members are registered as sole proprietors, we will deduct taxes based on national personal income tax rate of remuneration in People’s Republic of China and then remit payments to corresponding accounts.

Taxation Rate for members as sole proprietors (Examples of taxes calculation are based on monthly remuneration):

1)If remuneration is less than or equal to 800, no taxes will be deducted

2)If remuneration is greater than 800 and less than or equal to 4000, taxation rate is 20%. Taxes=(Remuneration applied-800)*20%

3) If remuneration is greater than 4000 and less than or equal to 20000, tax allowance is 20%, and taxation rate is 20%. Taxes= (Remuneration applied – remuneration * 20%) * 20%

4)If remuneration is greater than 20000 and less than or equal to 50000, tax allowance is 20%, and taxation rate is 30%. Taxes= (Remuneration applied- remuneration*20%)*30%-2000

5)If remuneration applied is greater than 50000, tax allowance is 20% and taxation rate is 40%. Taxes= (Remuneration applied – remuneration * 20%) * 40% - 2000

When to submit invoices and relevant information?

Date of invoices submission:

Mail to LinkHaitao before the 14th each month

If we receive invoices from members, we will not deduct any taxes. (Invoices submitted must be from legal service industries).

Is there any withdraw limit and currency requirements?

The minimum remuneration remittance is greater than or equal to 100 RMB. The basic unit of remuneration remittance is 100 RMB, the amount less than 100 RMB will automatically be transferred to next month.

For example, if member A’s monthly remuneration is 450 RMB, system will automatically transfer 50 RMB to next month.